I Got Hit By A Car While Riding a Bicycle: What Next?

Patricia

suffered a head injury and broken ribs when she was hit by a car while riding

her bike at the intersection of Transit Road and Main Street in the town of

Clarence, New York. When Daniel, the driver, ran a red light, he knocked her

off of her bicycle. A witness who observed the crash called 911. The police completed

a report including contact information of those involved, insurance

information, and a summary of the crash. The paramedics who arrived provided

treatment.

Being the victim of an accident was the last thing on Patricia’s mind. Rarely does anyone anticipate a serious accident, and rarely does anyone know exactly what to do next. Under significant stress, both Patricia and her family had so many questions, including who would pay for her medical bills and wage loss.

In this case, because

New York is a no-fault state, it doesn’t matter whether it was Patricia or Daniel’s

fault when it comes to paying medical bills and wage loss. As the driver, Daniel’s

insurance carrier will pay. Even if Patricia owns a car and has her own car

insurance or medical insurance, Daniel’s insurance will pay the bills for her

treatment, wage loss, and out-of-pocket expenses. Also, if Daniel’s insurance carrier

“accepts” the claim and Daniel has “collision” coverage for property damage, his

insurance carrier will cover those damages, too.

At some point after the crash, Patricia will need to provide Daniel’s no-fault insurance information to her medical providers so that they bill the carrier for her treatment. More specifically, she will need to obtain an insurance claim number, and share that claim number with each of her medical providers. Patricia should not submit any of her medical bills to her own medical insurance company. Although some primary care providers do not accept no-fault insurance, which creates an exception to the rule.

Patricia will also

need to file the appropriate no-fault application (NF6) within 30 days of the accident.

In order for Patricia to receive no-fault wage loss payments from Daniel’s

carrier, she will authorize Daniel’s carrier to verify her employment and

provide Daniel’s insurance company with disability statements she receives from

her treating doctor. If eligible for New York State disability, she will need

to execute the proper disability application (DB450), and apply for disability

through her employer. If she is self-employed, she will need to follow these

same steps.

Assuming that Daniel

has basic personal injury protection (PIP), Patricia’s no-fault insurance carrier

will pay 80 percent of her average weekly wage, up to $2000 per month, less her

disability. Depending on Daniel’s policy, she may be eligible for additional

coverage limits, known as APIP.

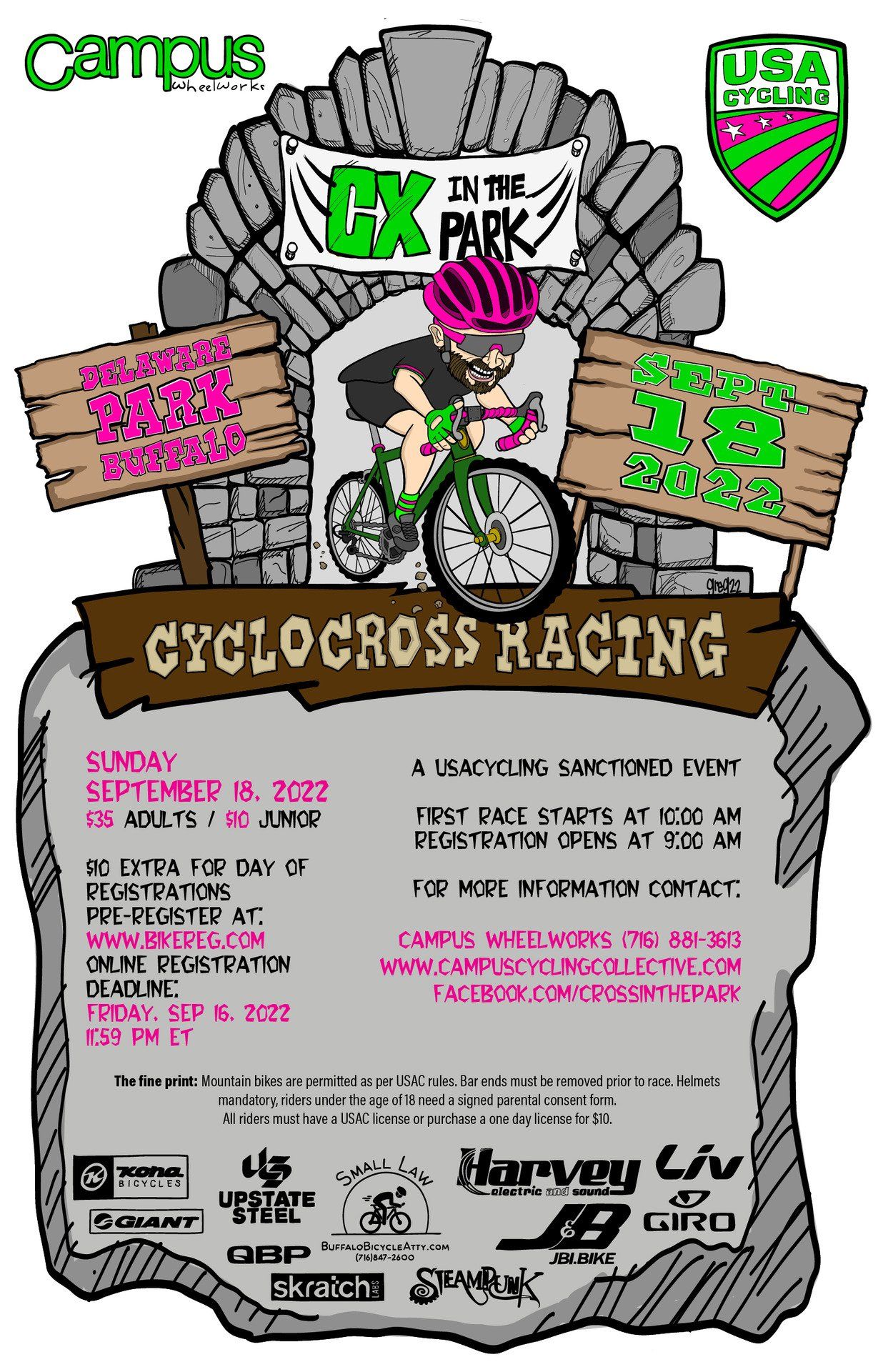

As specialists in bicycle law, Small Law Firm attorneys see many cases like Patricia’s. If you are hurt while riding a bike and need legal advice, call us at 716-847-2600 and visit www.buffalobicycleattorney.com. As strong biker advocates, we are here to assist you with questions about your claim and the no-fault process.

424 Main Street, Ste 1904 ❖ Buffalo, NY 14202 ❖ (716) 847-2600

Serving Amherst, Batavia, Buffalo, Niagara Falls, Cheektowaga, Clarence, Hamburg, Lancaster, Orchard Park, West Seneca, Rochester, Syracuse, NY & the Surrounding Community

ATTORNEY ADVERTISING