"Sum" Coverage Applies to Bikers, Too!

Car insurance is expensive. But you shouldn’t skimp if you can afford it. Getting caught up in “saving 15%” is a sure-fire way to lose out on valuable coverage.

Supplemental Underinsured Motorist (SUM) coverage is separate from liability, no-fault, or collision coverage. “SUM” applies when the “at-fault” driver’s policy limits are not enough to pay your damages.

The SUM coverage adds a layer of monetary protection. A car can legally drive on the highways in New York with a minimum liability policy of $25,000.00. This provides a seriously injured person with up to $25,000.00. In that situation, you would be left asking where the next layer of coverage was coming from.

The answer, in part, is in the SUM limits of your own auto policy. Without it, you are essentially relying on the policy limits of a total stranger. Increase your SUM limits to $100,000 or $300,0000 per person to add a layer of protection for compensation of pain and suffering, wage loss, and medical bills.

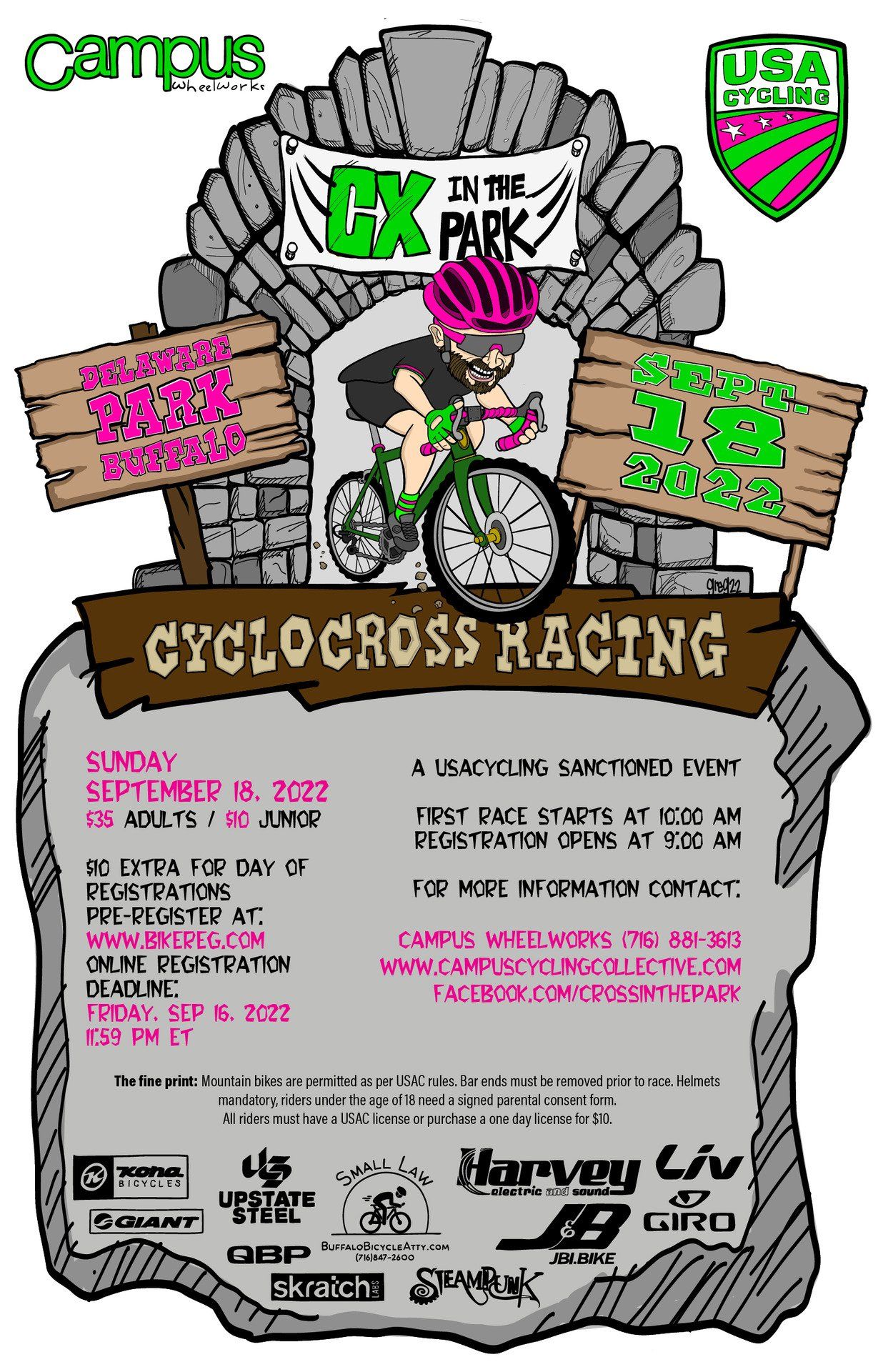

Just as important to know, if you own a car but happen to be on your bike or crossing the street and hit by a car, your SUM coverage applies. Bikers and pedestrians can make claims against their own automobile policy for SUM coverage. When necessary, talk to Small Law, Buffalo’s Bike Injury Attorneys.

424 Main Street, Ste 1904 ❖ Buffalo, NY 14202 ❖ (716) 847-2600

Serving Amherst, Batavia, Buffalo, Niagara Falls, Cheektowaga, Clarence, Hamburg, Lancaster, Orchard Park, West Seneca, Rochester, Syracuse, NY & the Surrounding Community

ATTORNEY ADVERTISING